How to Build a Great Credit Score in 2025?

Disclaimer

The information provided here is intended solely for educational purposes and should not be considered professional financial advice.

Do You Know Your Credit Score?

If you are unsure of your credit score, it is crucial to find out. Many banks offer free access to your credit score if you have an account with them. Alternatively, you can request a free annual credit report from one of the major credit bureaus, such as TransUnion, Equifax, or Experian.

Why Is Your Credit Score Important?

Your credit score plays a pivotal role in many aspects of your life. It can impact your ability to:

- Purchase a car

- Secure a job

- Rent an apartment

- Buy a house

- Apply for various types of credit, including credit cards and even some debit cards

Lenders rely on your credit score to assess your creditworthiness—essentially evaluating how likely you are to repay borrowed money. Your credit score not only determines whether a lender will approve your application but also influences the loan amount, the terms, and the interest rate.

For individuals with lower credit scores, lenders may require collateral or charge higher interest rates, as they perceive such borrowers to be high-risk. Therefore, maintaining a good or excellent credit score can save you significant money over time and improve your access to financial opportunities.

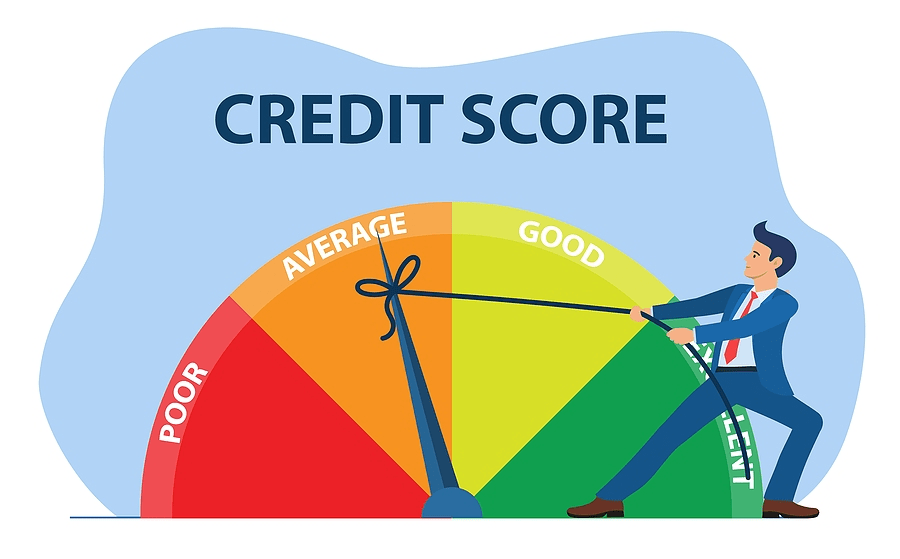

What Is a Good Credit Score?

Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Here's a breakdown:

- 300–579: Poor

- 580–669: Fair

- 670–739: Good

- 740–799: Very Good/Excellent

- 800–850: Exceptional

It is important to note that many lenders make little distinction between scores above certain thresholds (e.g., 740+ or 760+). This means that if your score exceeds their benchmark, you may receive the same rates whether your score is 741 or 841.

Factors That Affect Your Credit Score

- Payment History (35%)

Payment history is the most significant factor in your credit score. Consistently making on-time payments on credit cards, loans, and mortgages demonstrates reliability and builds trust with lenders.Conversely, missed payments or events like bankruptcy can significantly harm your score. The longer and more frequent the missed payments, the greater the negative impact. For instance:- A single missed payment can cause a noticeable drop in your score.

- Prolonged delinquencies (60, 90, or 180 days) can severely damage your creditworthiness.

- Credit Utilization (30%)

Your credit utilization ratio—the percentage of your available credit that you use—is another critical factor.How to calculate it:

Suppose you have three credit cards with the following limits:Your total credit limit is $19,000. To maintain a good credit score, aim to keep your overall utilization below 30%—in this case, $5,700. It’s also recommended to keep the utilization below 30% on each individual card. Ideally, keeping your utilization under 10% can maximize your score.- Card 1: $10,000 limit

- Card 2: $5,000 limit

- Card 3: $4,000 limit

- Length of Credit History (15%)

Lenders prefer borrowers with a long credit history, as it provides more data to evaluate your financial habits.Tip: Avoid closing older credit accounts, even if you rarely use them, as their longevity benefits your credit score. The average age of all your accounts is used to calculate this factor, so maintaining older accounts can improve your overall score. - New Credit Inquiries (10%)

Every time you apply for new credit, lenders perform a “hard inquiry,” which temporarily lowers your score. These inquiries generally fade after three months and are removed entirely after two years. To achieve a top-tier credit score, aim for fewer than two inquiries in a two-year period. - Credit Mix (10%)

Having a diverse mix of credit accounts—such as credit cards, car loans, and mortgages—demonstrates that you can responsibly manage various types of credit. Additionally, having a history of 20+ accounts can further strengthen your score.

Conclusion

My credit score typically ranges between 780 and 820, depending on the credit scoring service. I maintain this high score by focusing on the critical factors mentioned above, particularly avoiding missed payments and keeping my credit utilization low.

The areas where I occasionally face challenges are credit inquiries and length of credit history. Each time I apply for a new credit card or loan, my score takes a temporary hit in these categories. However, this is a trade-off I accept for the opportunity to access attractive credit offers.

If you must prioritize certain factors, focus on:

- On-time payments

- Low credit utilization

These have the most significant impact on your score and can help you achieve long-term financial success.